Since the outbreak of the Greek economic crisis, a prolonged and deep recession now over six years long, fuel-sector companies have been treated as cash cows by the succession of governments for tax revenues used to fill various holes in the national budget. However, from a certain point onwards, the approach began to backfire as the heavy load of taxes imposed on fuel elevated Greek fuel prices to an extent that made them Europe’s highest, a development that has severely subdued demand and, ultimately, reduced the government’s fuel-linked tax revenues. The various taxes imposed on fuel in Greece now constitute 70 percent of retail prices. Fuel trading firms have generally performed woefully, incurring losses for some years now.

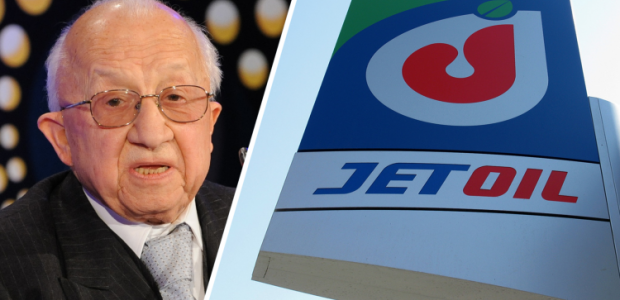

The local fuel sector’s financial troubles made tragic headlines over the weekend with the suicide, according to a coroner’s findings, of 84-year-old entrepreneur Kyriakos Mamidakis, founder and president of Mamidoil Jetoil, an enterprise that had filed for bankruptcy on June 9.

At its peak, Jetoil held a 10 percent market share following the addition of the Dracoil and El Petrol retail networks to its ranks.

The country’s network of petrol stations has shrunk from roughly 8,500 stations to 6,000 stations over the past few years.

According to certain sources, another petrol trading firm, one of the market’s smaller players, is headed for bankruptcy, while more victims, both in wholesale and retail, could emerge.

The latest taxes imposed on fuel have further increased the pressure felt in the sector. According to latest fuel market data, fuel demand in June plummeted 14 percent, an unprecedented drop in a month. Auto fuel demand fell seven percent in June.

Some market officials contend the government’s latest tax and social security revisions have yet to impact the fuel sector. These sources forecast that between 200 to 300 more petrol stations will soon go out of business as a result of the measures.