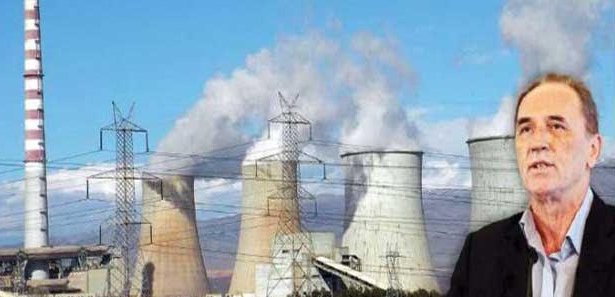

Energy minister Giorgos Stathakis appears determined to push for a convertible bond issue as an alternative plan for the main power utility PPC when, or if, the time comes to negotiate, with the lenders, the utility’s sale of a 17 percent stake.

The corporation’s particularly low share-based value at present does not make an accelerated book building approach a preferable option, according to the minister.

Ministry sources contacted by energypress noted that the country’s lenders cannot push for the sale of PPC’s 17 percent before matters concerning the bailout-required sale of PPC lignite units, representing 40 percent of lignite capacity, have cleared up.

A tender for the sale of lignite units is expected next month. Prefered investors are not expected to emerge until autumn, meaning the lignite units sale procedure will not be finalized before the end of the year.

Energy ministry officials presume that, until then, no moves will be made for a sale of 17 percent stake of PPC.

However, the 2018 state budget foresees 100 million euros from the sale of PPC’s 17 percent. A bond issue will be considered should the sale of PPC’s 17 percent stake be raised by the lenders before the lignite units sale is completed, ministry officials noted when asked by energypress how they plan to cover this amount.

Meanwhile, the PPC union Genop is preparing to stage a series of 48-hour strikes as of next week, when a draft bill for the lignite units sale plan is expected to be ratified in parliament.

The Genop committee has planned a meeting for today to discuss the details of the union’s strike-action strategy. The country may face electricity supply problems during the action, which is expected to include power plant occupations and output disruptions.