The country’s two biggest energy consumers, restructured Aluminium of Greece, a member of the Mytilineos corporate group since 2005, and Larco, the state-controlled general mining and nickel producer, stand on completely different ground in terms of profit performance.

Spared of financial burdens of the past and now pushing ahead with an aggressive cost-cutting policy, investments and more efficient production management, Aluminium of Greece is already registering record production levels that are expected to generate record profit figures in 2017.

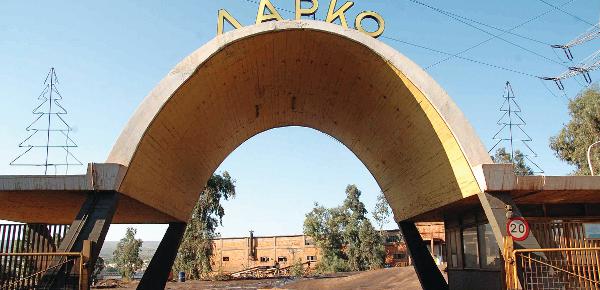

Meanwhile, Larco, unable to rebound as a result of high production costs amid low market prices, continues to incur losses and sink deeper into debt, which is negatively impacting electricity supplier PPC, the main power utility. Larco is having serious problems covering its electricity bills owed to PPC, despite a series of payback program revisions.

In 2013, when nickel prices averaged 15,000 dollars per metric ton, Larco’s turnover figure reached 207 million euros for a loss of 76 million euros. This year, the price of nickel slid to 8,000 dollars per metric ton before slightly rebounding to 11,600 dollars per metric ton.